The World Steel Assn. forecasts steel demand growing by 5.8% to 1.87 billion metric tons this year, after a slight decrease in 2020, with an automotive sector rebound among the leading factors.

The World Steel Association forecasts that global steel demand will rise 5.8% this year to 1.87 billion metric tons, then a further 2.7% to 1.92 billion metric tons in 2022. Demand from automotive and construction sectors offer the best prospects for growth. These predictions follow a year of slightly declining (-0.2%) demand in 2020, with major consuming industries like automotive and construction beset by pandemic-related restrictions and supply-chain disruptions.

World Steel added that its new forecast assumes that second- or third-waves Covid-19 outbreaks will stabilize in Q2 2021, and that vaccinations will contribute to “a gradual return to normality in major steel-using countries.”

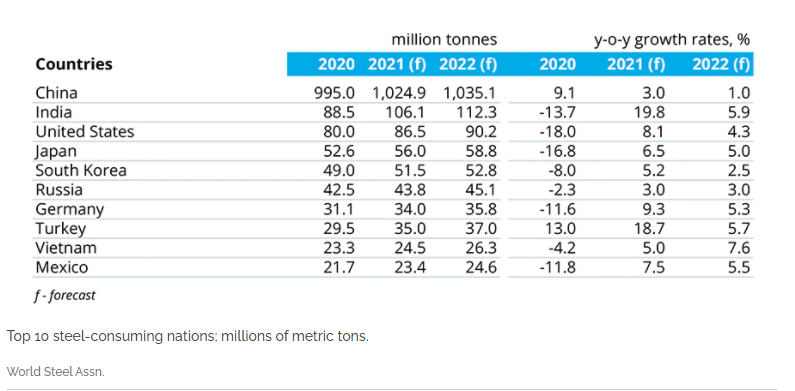

According to Saaed Al Remeithi, chairman of the World Steel Economics Committee, “the global steel industry was fortunate enough to end 2020 with only a minor contraction in steel demand. This was due to a surprisingly robust recovery in China, with growth of 9.1%. In the rest of the world steel demand contracted by 10.0%.”

U.S. steel demand — The U.S. economy made a strong recovery from the March 2020 pandemic wave due to substantial fiscal stimulus supporting consumption, which helped durable goods manufacturing. However, overall U.S. steel demand fell -18.0% year-over-year in 2020. A new infrastructure plan “may have upside potential for steel demand in the longer term,” according to World Steel, but short-term steel-demand recovery will be limited by weaknesses in non-residential construction and energy sectors.

On the other hand, the U.S. automotive sector is forecast to recover considerably.

Last, the industrial machinery sector suffered from cuts in capital investment during 2020, and supply-chain disruption was another considerable factor. Improvements to supply-chain flexibility and reliability, and an accelerating trend toward digitization and automation will drive growth in industrial machinery demand in 2021, World Steel indicated.

“In the coming years,” Al Remeithi continued, “steel demand will recover firmly, both in the developed and developing economies, supported by pent-up demand and governments’ recovery programs. However, for most developed economies a return to the pre-pandemic levels of steel demand will take a few years.”